rhode island income tax rate 2021

In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per child up to a maximum of three. Rhode Island Income Tax Calculator 2021.

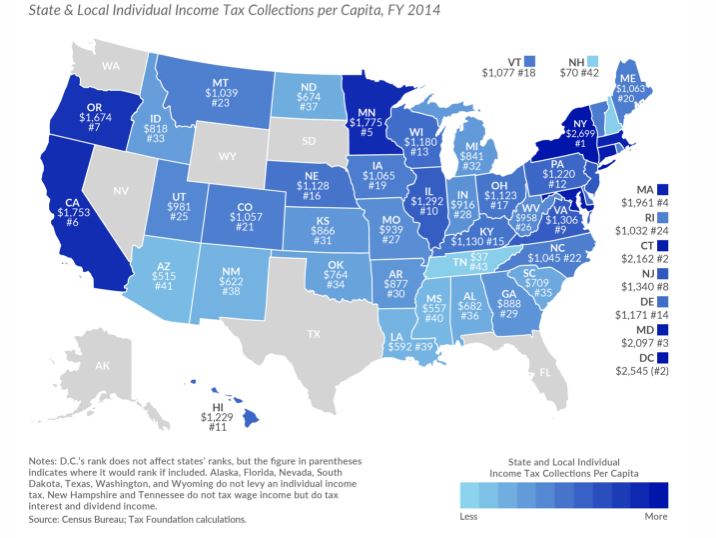

R I State And Local Income Tax Per Capita 2nd Lowest In New England

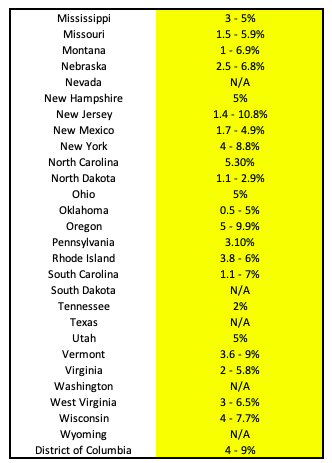

The table below shows the income tax rates in Rhode Island for all filing statuses.

. If you make 120000 a year living in the region of Rhode Island USA you will be taxed 26200. Tax rate of 475 on taxable. Your average tax rate is 1651 and your.

Your average tax rate is 1758 and your. Rhode Island Income Tax Calculator 2021. Apply the taxable income computed in step 5 to the following.

The Rhode Island income tax has three tax brackets with a maximum marginal income tax. In order to be eligible for the Child Tax Rebate please remember to file your tax year 2021 Personal Income Tax Return by August 31 2022 or if you have filed an extension. 4 rows The Rhode Island income tax has three tax brackets with a maximum marginal income tax.

Over But not over Pay percent on excess of the amount over 0 66200 -- 375. 3 rows The Rhode Island State Tax Tables for 2021 displayed on this page are provided in support of. Tax rate of 375 on the first 68200 of taxable income.

Income Tax Calculator 2021 Rhode Island. Levels of taxable income. Any income over 150550 would be.

Exemption Allowance 1000 x Number of Exemptions. Total Estimated 2021 Tax Burden. Income Tax Calculator 2021.

51 rows Marginal tax rate 475. If you make 140000 a year living in the region of Rhode Island USA you will be taxed 32198. Interest on overpayments for the calendar year 2021 shall be at the rate of three and one-quarter percent 325 per annum.

Effective tax rate 385. If youre married filing taxes jointly theres a tax rate of 375. More about the Rhode Island Tax Tables Individual Income Tax TY 2021 We last updated the Income Tax Tables in January 2022 so this is the latest version of Tax Tables fully updated.

Tax Schedule F with rates ranging from 09 percent to 94 percent was in effect in calendar year 2020. DO NOT use to figure your Rhode Island tax. Uniform tax rate schedule for tax year 2021 personal income tax Taxable income.

The 2021 UI and TDI Quick Reference sheet is available here. As you can see your income in Rhode Island is taxed at different rates within the given tax brackets. Rhode Island Tax Brackets for Tax Year 2021.

Income Tax Calculator 2021 Rhode Island 119500. Rhode Island state tax 2693. However if Annual wages are more than 231500 Exemption is 0.

Instead if your taxable income is less than 100000 use the Rhode Island Tax Table located on pages T-2 through T. In Rhode Island theres a tax rate of 375 on the first 0 to 66200 of income for single or married filing taxes separately. Income Tax Sales Tax Fuel Tax Property Tax.

The rate so set will be in effect for the calendar year 2021.

State By State Guide To Taxes On Retirees Kiplinger

Focus On Rhode Island Miles Consulting Group

Ri Health Insurance Mandate Healthsource Ri

Tax Rate Schedules And Important Rules For 1099 Contractors Taxhub

Report Rhode Island Has Turned Away Over 1billion In Federal Affordable Housing Funds

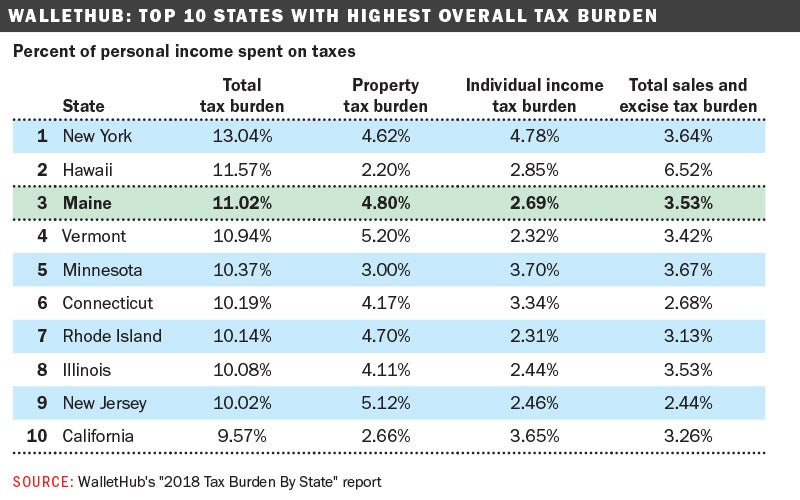

Maine Makes Top 5 In States With Highest Tax Burden Mainebiz Biz

Free Tax Resources Tools And Tips To Simplify Tax Season Lili Banking

Tax Assessor City Of Pawtucket

What Is The Corporate Tax Rate Federal State Corporation Tax Rates

Rhode Island American Gaming Association

Top States For Business 2022 Rhode Island

Rhodeislandtax Rhodeislandtax Twitter

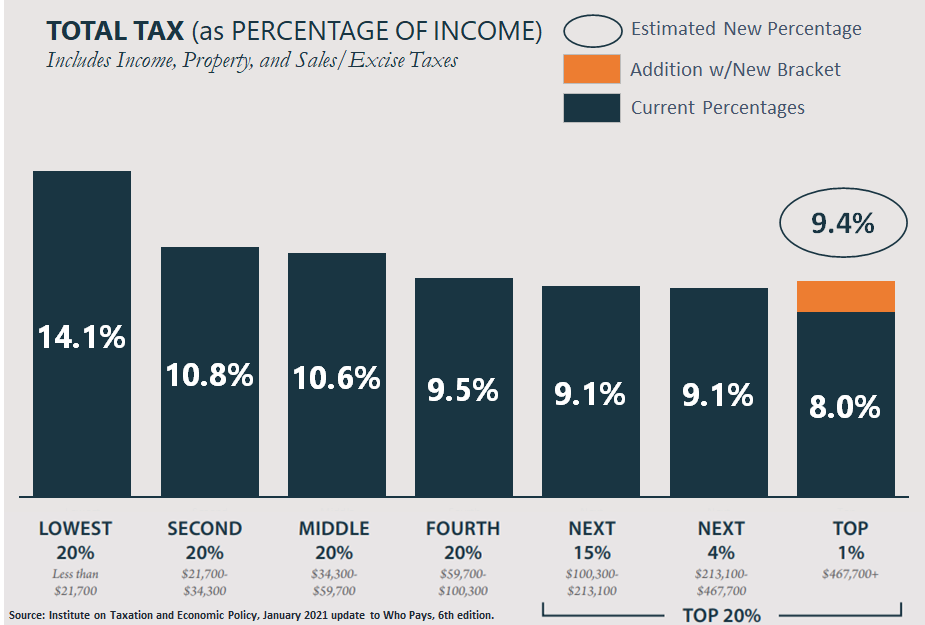

Debunking The Providence Chamber Ripec False Claims About Increasing Taxes On The Top One Percent Economic Progress Institute

Rhode Island Employers To See Flat Unemployment Insurance Taxes In 2022 Providence Business First

2022 Tax Brackets How Inflation Will Affect Your Taxes Money